A couple years ago when the economy was at full steam 30 Year Fixed loan rates were in the upper 5% and low 6% range. So the question that all home buyers need to ask now is “How will a rise in mortgage rates affect my purchasing power?”

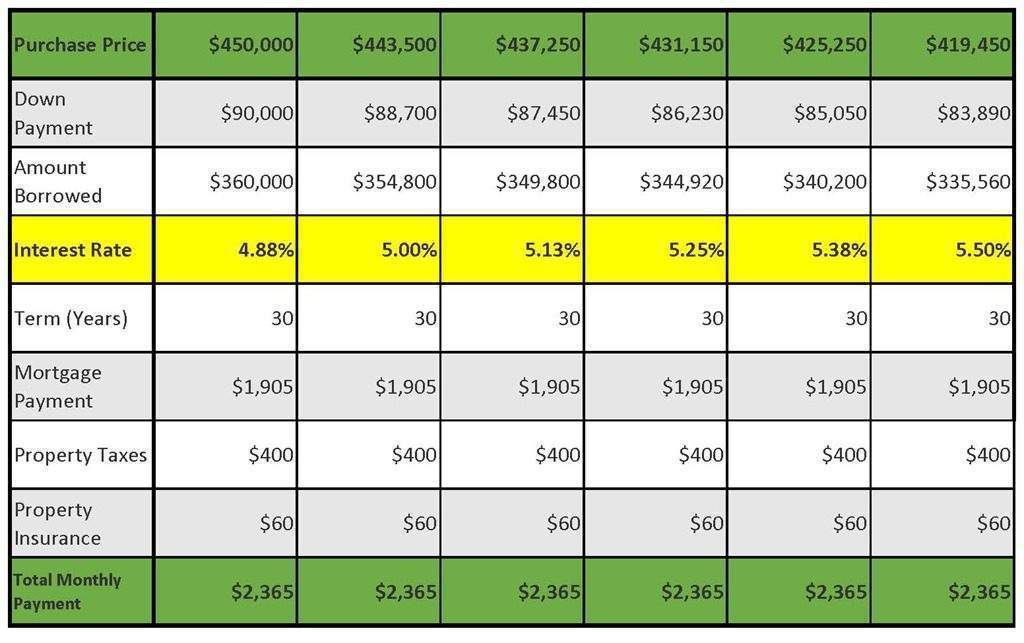

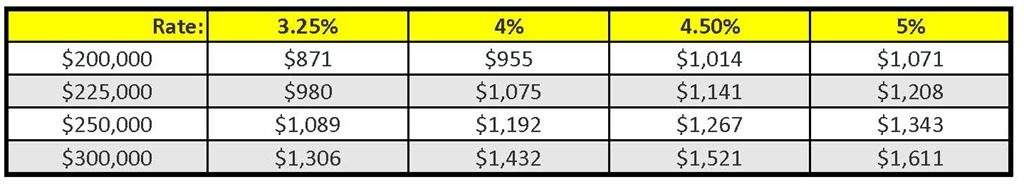

The exact numbers vary based on your desired purchase price, I’d like to give you an idea in the chart below.

A .5% increase in the interest rate from 4.875% to 5.375% would result in roughly a $25,000 decrease in purchasing power!

That could be a huge difference in homes to choose from or leave the buyer with limited negotiating flexibility. When you also look at the amount of money paid out in interest over the 30 year period of the loan there’s a savings of $40,000 in interest between the two rates for the same loan amount.

So buyers who are thinking about purchasing now but are waiting for prices to drop slightly beware! They may end up negating any gains there by being stuck with an interest rate that’s substantially higher a month or two down the road.

[button size=”large” url=”https://www.jayjenkins.com/traciwaller/” expand=”true”]GET PRE-APPROVED[/button]

Information courtesy of Traci Waller of Advance Financial Group. This is for informational purposes only and should not be relied on by you. Rose and Womble Realty Company is not a mortgage lender. Contact Advance Financial Group directly to learn more about it’s mortgage products and your eligibility for such products. NMLS# 512138 Equal Housing Opportunity Information is subject to change without notice. This is not an offer for extension of credit or a commitment to loan.