This guide will give you important information about how I work for you to make the buying process easy and stress free, and why you want to hire a professional Realtor to find your new home.

My Buyer Services

Communication and Counseling

- I focus on your wants and needs.

- I return calls/messages promptly and maintain communication during the process.

- I’m here to go over all documents and answer any questions you have prior to signing.

Education and Information

- I research constantly to stay updated on changes in the market.

- I’ll explain all steps of the home buying process.

- I will help to familiarize you with the communities and neighborhoods.

- I am your continued real estate resource after closing.

- I provide upgrade or remodeling guidance with my home renovation experience.

- I can advise you on real estate investments also.

Specialized Buyer Broker Services

- Research and evaluate the pricing of any properties of interest so you know if they are priced correctly.

- I work with you to recommend the price and terms when presenting an offer to purchase.

- I guarantee client confidentiality and work to strengthen you negotiation position.

- I review the contracts and negotiate the best offer with you.

- I present all offers and counter offers in a timely manner and the pros and cons of our options.

- I only represent your interests during your home purchase.

- I provide financial guidance and work directly with your loan officer to expedite the process.

- I can assist you in obtaining financial pre-qualification and comparing mortgage options.

- I work within your comfortable price range of homes.

- I work with the mortgage company in obtaining your financing.

Professional Support

- Schedule and organize all tours of the properties you select.

- I attend inspections and advise you on all your options and I attend your final walk through and closing.

- I am in constant communication with your attorney or settlement agent and lender to ensure a smooth closing.

And that’s just the beginning.

I will be your Real Estate Resource for life!

Benefits of Working with Jay Jenkins

Finding and buying your perfect house is a complex situation. You are in competition with other buyers looking to buy their dream homes. There is a big difference in the level of expertise and quality of real estate agents. Give yourself the advantage of working with the very best!

My skills and services

make a BIG difference for you!

Highly Trained Buyer Representative: I’m trained and educated in buyer representation to focus on finding your ideal home. I am committed to you and work with you throughout the entire buying process.

Instant Notification System: I will create your personal search website to sort all your potential homes and show you new homes as soon as they hit the market. You will be able to make notes, reject homes and mark your favorites all while receiving the most up to date information.

The Largest Inventory of Homes for Sale: I give you access to ALL listings, not just those on the Multiple Listing Service. I can help you find new construction, contact For Sale By Owner homes, and clients who may be considering selling their homes but haven’t put them on the market yet.

Expert Negotiation Skills: I have helped dozens of families find and purchase their dream home. My past client reviews are a testament to the expertise and negotiating skills that give my clients an advantage over buyers working with other agents.

Bargaining Power: I tell you everything I know about a specific property’s price, terms and conditions and the local market in order to give you the best bargaining position possible.

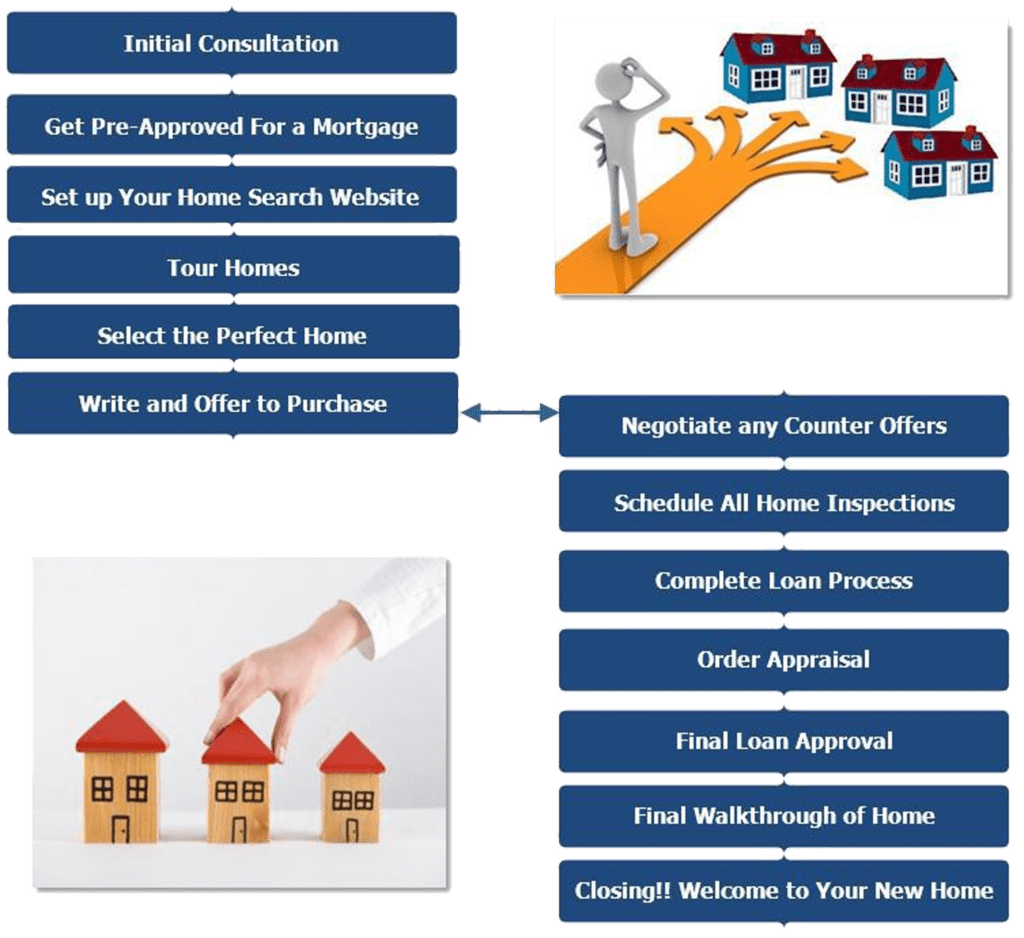

The Home Buying Process

Not everyone with a real estate agent license is a REALTOR. A Realtor is also a member of the National Association of Realtors and must meet stricter education requirements than the law requires, and they’re bound not only by the law, but by the higher standard of the Realtor Code of Ethics.

That’s why only Realtors are allowed to use the Realtor logo. Your Realtor protects your interests throughout the entire transaction with the integrity, honor, professionalism, and expertise that meets the high standards set by the REALTOR code of ethics.

Your Realtor isn’t just an expert on your local real estate market, but also a trusted advisor who will help you navigate a complex transaction.

“What will a Realtor do for me?”

When you’re buying, your realtor will…

- help you determine how much home you can afford

- explain financing options and help you find the right loan

- assist in your home search through the Multiple Listing Service, or with houses you find through other Web sites

- provide objective data about each property – including helping find information you might not realize is available

- provide negotiating expertise, and help resolve any issues that arise with the seller that could delay closing or void the contract

- help you get and understand any homeowner association documents

- coordinate appraisals and other issues your lender may require

- help you determine what inspections are necessary, such as for water damage, asbestos, and mold, and the condition of the roof and heating and cooling systems – just to name a few

- explain earnest money deposits, escrow accounts, and closing costs

- go on a final walk-through to make sure everything is in order and any repairs have been made properly

- work with you and the seller’s agent to reach a smooth and problem-free closing

When you’re selling, your realtor will…

- go over the market conditions to help you set the right price for your home based on everything from size and condition to recent sales in your neighborhood

- find the best places to market your property – including the Multiple listing Service, social media, and other avenues that may not be available to the general public

- help prepare or “stage” your home for sale by suggesting small improvements that can make a big difference – everything from arranging furniture to choosing the right paint color

- take professional photos and video, and make sure they’re included in your home’s advertising

- coordinate inspections, appraisals, and other issues to ensure a smooth closing

- provide negotiating expertise. and help resolve any issues that arise with the buyer that could delay closing or void the contract

- work with you and the buyer’s agent to reach a smooth and problem-free closing

The Nuts and Bolts of Working With Your Realtor

Choose your Realtor the way you would choose a doctor, accountant, or other professional: Meet with several, take a friend or colleague’s recommendation, or look for one with great past client testimonials.

Once you’ve found the Realtor you want to represent you, you enter into what’s called a “brokerage relationship.” In order to work together, you and your Realtor need this. It outlines what services the Realtor will provide, how long they will be providing those services for and what the administration fee is.

This agreement might be for a single day — to see a few houses — or several months. In most cases, your Realtor will act as what’s called a standard or “full-service” agent, providing you with a wide range of assistance and all the advantages of having a trained real estate professional working for you.

There are other options available to you, including hiring a Realtor as a limited-services agent. I can explain the benefits and drawbacks of each relationship. Remember that together you will decide what kind of working relationship works best for you.

Whatever you and your Realtor agree to, once you’ve signed that brokerage agreement, your Realtor can start working for you and representing your interests. Whether you’re buying or selling your home — or just checking out your options – you need the expertise of someone whose job it is to know your local market inside and out.

Bottom line: You need a Realtor

What is Pre-Approval?

It is extremely important that you connect with a local lender. My Premier Lender has earned my trust and my past clients have had exceptional experiences with her. She will work with you to determine the price you are most comfortable with and get you pre-approved.

The pre-approval process will help you in several ways:

- You will have a better understanding of what your payments will be.

- You won’t waste time considering homes you cannot afford.

- You can select the best loan package without being under pressure. There are many options and programs to choose from in today’s market. Your lender will explain the alternatives to help you select the one best suited for you.

- Sellers will find your purchase offer more favorable if they know in advance of your ability to secure financing. This will make your offer more competitive if you are in competition with other offers. Today, most listing agents require a pre-approval or approval letter to accompany a purchase offers.

- You’ll have an estimate of your closing costs and we will explain them to you in detail.

- You’ll have peace of mind.

You live in the payment. The price of the home is less important than what you have to pay each month.

What Will the Lender Need?

- 30 Days most recent pay stub for each borrower

- Current LES for military borrowers

- For VA Loans: DD214 or copy of Statement of Service

- 2 Years W2’s for each borrower (1099 if not a W2’d employee)

- 2 Years Federal Tax Returns, all pages

- 2 Months bank statements all pages for checking, savings, retirement, stocks, bonds, etc.

- Copy of Driver’s License, U.S Residency card or Gov’t Issued ID

The “Do’s and Do Not’s” of Your Loan Process

Do…

- Keep accounts current, such as; mortgages, car payments, and credit cards.

- Make payments on current accounts on time, even if the account is being paid off with your new loan.

- Keep copies of all paycheck stubs, bank account or asset statements, along with any statements for bills being paid off through this loan.

Do not…

- Make any large cash deposits.

- Quit or change jobs unless it is the same line of work and for equal or more money. Call your loan officer if this should occur.

- Allow anyone to make an inquiry on your credit report.

- Make a large purchase (car, motorcycle, other real estate).

- Co-sign for anyone else on a loan.

- Apply for credit, take on additional debt, or complete any other credit application.

- Charge additional debt on any existing credit account that you have.

What are my closing costs going to be?

Lenders charge fees for giving you a mortgage.

In addition to the lender’s fees, there are other closing costs when you purchase a home:

- Title fees

- Recording fees

- City and state transfer taxes, etc.

Most of the buyer’s closing costs are generated by the mortgage.

The lender’s points (also referred to as the service charge) will be your largest fees and usually run between 1 % and 3% of the loan amount. Occasionally, the points will run more than 3% and there are some loans available with zero points.

Your lender will make all this easier by explaining your options and showing you the pros and cons of each.

Who Pays for What at Closing?

The Seller Normally Pays…

- Real estate brokerage fees.

- Payoff of all loans in seller’s name.

- Fees, re-conveyance fees, and prepayment penalties.

- Home warranty according to the contract, if any.

- Any judgments, tax liens, , against the seller.

- Recording fees to clear all documents of record against the seller.

- Tax pro-ration. This is for any unpaid taxes at the time of transfer of title.

- Any unpaid homeowner-association dues.

- Any assessments according to the contract.

- Grantors tax.

- New approval of well, septic, and as-built survey (if required per contract).

- Re-inspection fee with appraiser or home inspector (as negotiated in contract).

- Deed preparation

The Buyer Normally Pays…

- Lender’s title-policy premium

- Owner’s title insurance

- Recording charges for all documents in buyers’ names.

- All new loan charges (except those required of the seller by the lender).

- Interest on a new loan from date of funding to 30 days prior to first payment date.

- Assumption/change-of-records fees for takeover of existing loan.

- Home warranty according to contract.

- Homeowner’s insurance premium for the first year.

- Appraisal if not paid in advance

- Reserve account for taxes, insurance and POA escrow.

- Flood-certification fee.

- Cost of survey if ordered.

- Lenders re-inspection fees if required.

Considering New Construction?

When you go to a new construction site, you need someone to represent you!

The site agent at new construction represents the builder, not you! Their job is to put together a sale that is the best for the builder. You need your Realtor there to protect you as the buyer.

Buying new construction is more complicated and time-consuming than buying a resale home. I can professionally guide you through this process. My experience representing buyers in new construction gives me experience with the non-standard contracts that are used, inspection steps, upgrades, the building process and other aspects that only relate to new construction.

It is very important that your interests be professionally represented when you are entering into a contract for a new construction home. These transactions are complex and the contract details must be in order to protect you and to ensure that you get exactly the home you want!

“Are there any advantages to not using my own agent to purchase new construction?“

No. You pay nothing extra to be represented. Just as in any resale, the seller pays your agent’s fee. The builder has the advantage when you are not represented.

CAUTION: Most builders will make you give up your right to representation if you visit their model homes without an agent on the first visit. If you are interested in a new construction site call me first and I will visit the models with you.

Things Every Buyer Should Know Before Buying

- The most important decision you will make is choosing the right Realtor

- Property taxes and qualified home interest are deductible on an individual’s federal income tax return.

- Many times, a home is the largest asset an individual has and is considered one of the best investments available.

- A portion of each mortgage payment goes toward the principal, which is an investment.

- A home is one of the few investments you can enjoy while you’re still purchasing it!

- Your Realtor can show you any home, whether it is listed with a company, a builder or is a For Sale By Owner.

- Using a Realtor to purchase a For Sale By Owner is very advantageous for you, because even though the seller doesn’t have a professional looking out for their best interests, you do!

- A pre-approval will approve you for a specific loan amount subject to the property. In the current market this is required when making an offer on a home.

- The right to conduct a home inspection, included in your purchase agreement, gives you the ability to negotiate repairs with the seller or choose not to buy the home based on its condition.

- Don’t go ‘shopping for a deal’. Set your sights on the right house for you, and then let your Realtor help you negotiate the best price and terms.

What to offer for a home?

You want to know how much a house is worth before you make an offer.

After being pre-qualified by a lender, you already know the max you can spend. However, how much you want to spend has nothing to do with how much a seller is asking for their house.

The seller wants the most money possible and you want to pay the least amount of money. This leads to the negotiation process.

As your Realtor I will do a comprehensive price analysis before you decide on what you want to offer. I will look at the market, the sold and active homes, the area and other factors that affect value (school district, location, neighborhood amenities) so you can make an informed decision.

What are some contingencies that I can put in an offer?

A contingency allows you to back out of the contract for a specific reason. There are typically three contingencies with a purchase contract: financing (mortgage), home inspection, and attorney approval. There are many other contingencies that might appear in a contract for purchase including:

Sale of your prior home

Approval of home owners’ association rules and regulations

Approval of condo or HOA rules and regulations

Pest inspection, asbestos, lead

Compliance with building code

Flood hazard insurance